Federal estimated tax payments 2021 online

Crediting an overpayment on your. How do I pay my 2021 estimated taxes online.

Irs Has Videos To Help The Do It Yourself Tax Filer Estimated Tax Payments Internal Revenue Service Tax Deadline

The best way to.

. And is based on the tax brackets of 2021 and. Mail in five to seven business days at your IRS address of record. COVID-19 the American Rescue Plan Act of 2021.

Use Form 1040-ES to figure and pay your estimated tax for 2022. After this process is complete you will receive a personal identification number PIN via US. For example if your net profit is 10000 you calculate your self-employment tax as follows.

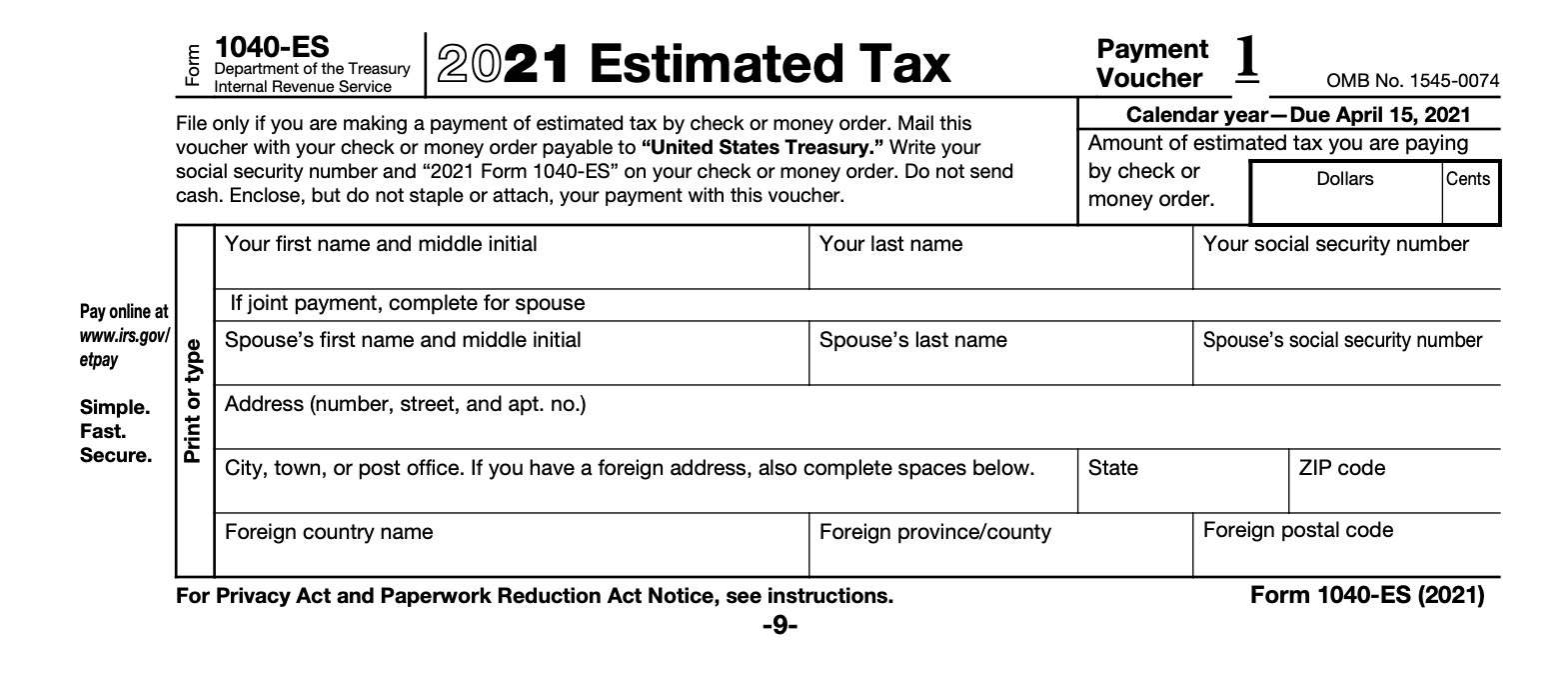

2021 Online 1040 Income Tax Payment Calculator. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. Reconcile your estimated payments by e-filing a 2021 Return.

Use this secure service to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings account at no cost to you. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. From within your TaxAct return Online or.

10000 x 09235 x 0153 1413. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. To make estimated tax payments online first establish an account with the IRS at the EFTPS website.

They can also visit IRSgovpayments to pay electronically. April 15 2021 for income earned January. Small business tax prep File yourself or with a small business certified tax professional.

Find answers to your questions about tax payments with official help articles from TurboTax. Payments using this Web site or. It is mainly intended for residents of the US.

Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of. 100 of the tax shown on your 2021 federal tax return only applies if your 2021 tax return covered 12 months - otherwise refer to 90 rule above only. United States Federal Personal Income Taxes Estimator Estimate How Much You Owe the Federal Government Need to Pay to the IRS in.

Bookkeeping Let a professional handle your small business books. To calculate estimated tax payments needed for the current tax year available to be done only with the early release version of the software. When it comes time to file your yearly tax return.

Form 1040-ES Estimated Tax for Individuals includes instructions to help taxpayers figure their estimated taxes. Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more. Get answers for TurboTax Online US support here 247.

Once you have an EFTPS account established you can schedule automatic. As a partner you can pay the estimated tax by. These were as follows for 2021 Taxes these deadlines have passed.

Mon - Fri 5am - 6pm PST Sat - Sun 7am 4pm PST.

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

When Are Taxes Due In 2022 Forbes Advisor

How To File Quarterly Taxes In An Instant

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Form 1040 Income Tax Return Irs Tax Forms Income Tax

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Covidreliefirs On Twitter Internal Revenue Service Irs Estimated Tax Payments

What Happens If You Miss A Quarterly Estimated Tax Payment

Estimated Income Tax Payments For 2023 And 2024 Pay Online

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

2

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax